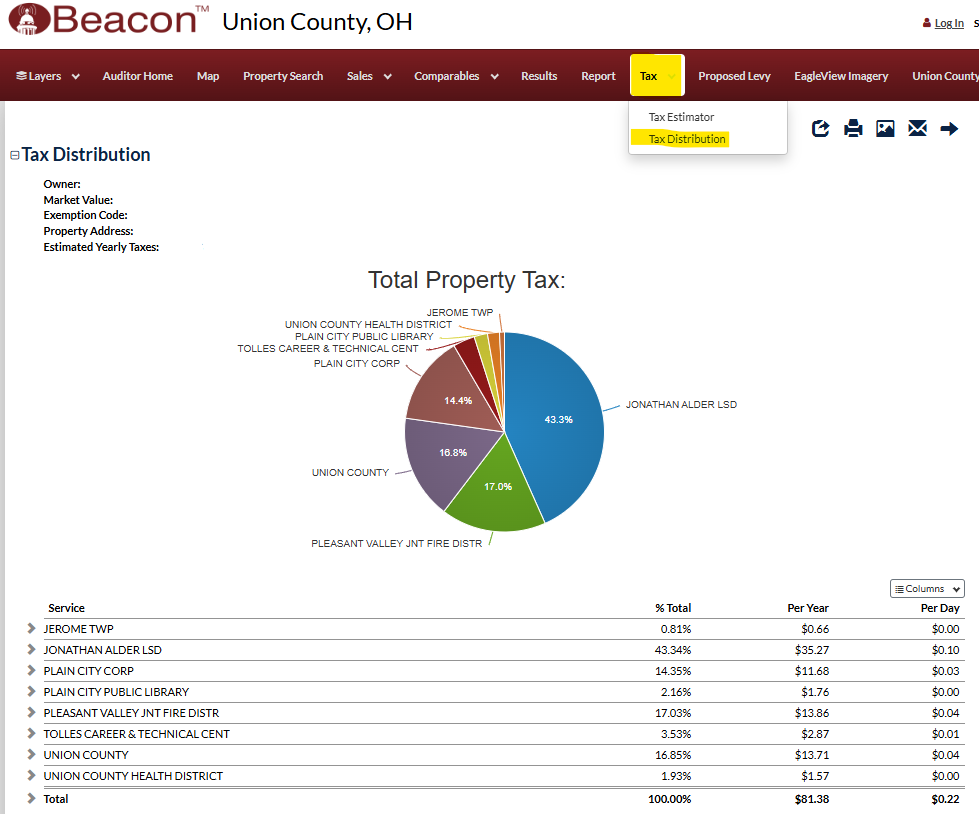

The CAUV Program allows for qualifying agricultural land to be assessed for tax purposes at its income producing capability rather than its market value. The CAUV program, on average, produces a significant tax savings for the property owner. Please click on the image below for a general summary PDF of the program or read the information below the image for a more detailed explanation and instructions on how to apply for the CAUV program.

Click the image to view a larger image of the handout.

CAUV Handout PDF Click here for a downloadable PDF copy of the above handout.

Information Concerning the CAUV program,

the Valuation of Land at its Current Agricultural Use and How to Apply if Qualified

DTE 109 Rev. 5/13

General Information and Filing Requirements

This information below pertains to the Current Agricultural Use Value (CAUV) program pursuant to Ohio Revised Code section 5713.31. Under this program, the taxes on qualified land are based on the agricultural use of land instead of its development potential. Only "land devoted exclusively to agricultural use" may qualify. If the property fails to meet the qualifications at any time or the owner withdraws from the program, a penalty will be charged equal to the tax savings over the prior three years.

The owner includes, but is not limited to, any person owning a fee simple, fee tail, life estate interest or a buyer on a land installment contract. A separate application must be filed for each farm, which includes all portions of land that are worked as a single unit within the same county. Although the tracts, lots or parcels that comprise a farm do not need to be adjacent, they must have identical ownership.

Time and Place of Filing Application

The initial application for the current tax year must be filed with the county auditor’s office after the first Monday in January and before the first Monday in March. "Filed" means received by the auditor’s office, not postmarked by the due date. The only exception to this deadline occurs during a reappraisal or update year. If the market value of the land increases during the revaluation and the auditor has not advertised the completion of the revaluation or notified the owner of the increase prior to the first Monday in March of the revaluation year, the application may be filed anytime before the first Monday in March of the following year.

If there is a transfer of CAUV acreage during the year, the acreage continues in the program if it meets the use test and either the new owner files an initial application or the previous owner has filed a renewal application meeting the filing deadlines.

Eligibility Requirements for Land Devoted Exclusively to Agricultural Use

Current Agricultural Use

Ohio Revised Code section 5713.30(A) contains the statutory definition of land devoted exclusively to agricultural use. Qualified land devoted exclusively to agricultural use means land used for commercial agricultural activity, which is limited to the following activities: commercial animal or poultry husbandry, algaculture, aquaculture, apiculture, the commercial production of timber, field crops, tobacco, fruits, vegetables, nursery stock, ornamental trees, sod or flowers and certain timber not grown for commercial purposes. Qualified land includes land devoted to biodiesel production, biomass energy production, electric or heat energy production, and biologically derived methane gas production if the land on which the production facility is located is contiguous to or part of a parcel of land under common ownership that is otherwise devoted exclusively to agricultural use, provided that at least 50% of the feedstock used in the production was derived from parcels of land under common ownership or leasehold. Agricultural use excludes processing facilities and plants such as grain elevators, slaughter- ing plants and wineries.

Land devoted to agricultural use includes parcels or portions of parcels that are used for conservation practices if it comprises 25% or less of the total land qualifying for CAUV. Conservation practices are used to abate soil erosion required in the management of the farm and include grass waterways, terraces, filter strips, field borders, windbreaks, riparian buffers, wetlands, ponds and cover crops for that purpose.

Qualifying Acreage

Qualifying acreage is the number of acres that meet the definition of agricultural use. To qualify for CAUV, land at least ten acres in size must have been devoted exclusively to commercial agricultural use during the three years prior to the year in which the CAUV application is filed. With certain exceptions, land less than ten acres must meet the same requirements and have earned a minimum average yearly gross income of $2,500 from the sale of products raised on the land during the three years prior to the filing of the application. If actual income figures are unavailable for the three-year waiting period, evidence of anticipated qualifying income may be submitted.

Other qualifying acreage includes land receiving compensation for certain land conservation programs under an agreement with the federal government. Currently, these programs meet this designation: the Conservation Reserve Program (CRP) and Conservation Reserve Enhancement Program (CREP).

Noncommercial Woodland

Qualifying acreage includes the growth of timber for a noncommercial purpose if the woodland is part of a farm with more than ten qualifying acres. The woodlands must be adjacent to or part of a qualifying parcel.

Mixed Use Parcels

Some applicants may own mixed-use parcels where only a portion of the land is qualified for the program. These parcels may be enrolled in the program if the areas are independently qualified under the CAUV guidelines and are appropriately identified to the auditor.

Click the link below to download the Initial CAUV application if, after reading the above, your property can qualify for the CAUV program or if you have recently changed the deeded name of, or placed into a trust parcel(s) located in Union County which qualified or can qualify for the CAUV discount.

CAUV Initial Application.pdf

An official State of Ohio government website.

Here's how you know

An official State of Ohio government website.

Here's how you know